A Balanced Market in Victoria

The Victoria Real Estate Board in their February 2024 news release in summary states, that while sales were up slightly based on last year’s number, overall, the stabilization last Spring and the recent leveling out of the mortgage rates and with inventory slowly making its way onto the market in 2024 we are seeing a balance to the real estate market.

A balanced market means there is opportunity for both sellers and buyers.

There has been a noticeable uptick in the number of people coming through Open Houses and making inquiries on listings. Potential sellers are also reaching out looking for a current market evaluation on their homes. Setting the right price is very important in a balanced market.

That adage on what you feel the value of your home is compared to your lender, your appraiser, your tax assessor, and the potential buyer there can be some big differences.

A seller wants top dollar. The buyer wants a bargain.

Real Estate Post-Covid

We all over value our own assets and post-COVID, many sellers are considering pricing their home based on what their neighbour’s home sold for just a year ago.

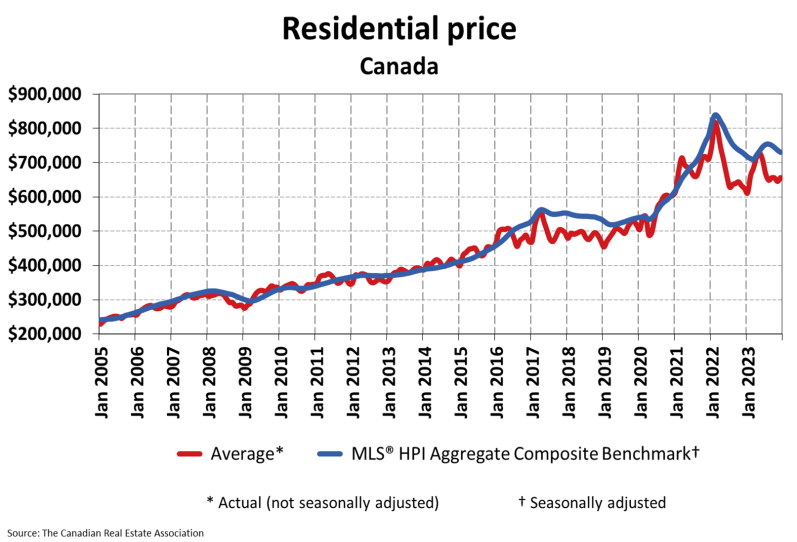

Across Canada, the peak price of real estate was in March 2022. Overall, prices have come down between 8 – 20% depending on your region’s market conditions.

While interest rates are holding steady, there is a prediction that those rates may come down sometime mid to late 2024, according to industry experts. There remains a severe housing shortage in Canada and housing affordability is at an all time low.

When pricing a home to sell, sellers may need to shift their perspective. Rather than feeling like they’ve lost money, they’re not selling at the top of the market.

That COVID bubble burst. Looking at what their home was worth prior to the bubble and comparing that to what it would likely be worth if that bubble never happened can help the seller gain a more accurate perspective.

As we can see, this graph from The Canadian Real Estate Association shows that COVID bubble and the resulting price correction. It’s important to point out that the straight line projects price IF the average annual appreciation had continued if COVID hadn’t occurred.

It’s all about perspective!

Current Mortgage Rates

What are the current mortgage rates?

According to the Mortgage Designers at Mortgage Architects, their 5 year rate is at 4.89% as compared to 7.04% with the banks. A 3 year fixed term as of February 9th is at 5.74%, a 5 year fixed term is at 4.89% and a 10 year fixed term is at 6.44%.

You can go to their mortgage rates page at https://www.mortgagedesigners.ca/index.php/victoria-bc-mortgage-rates.

Real Estate Statistics for January

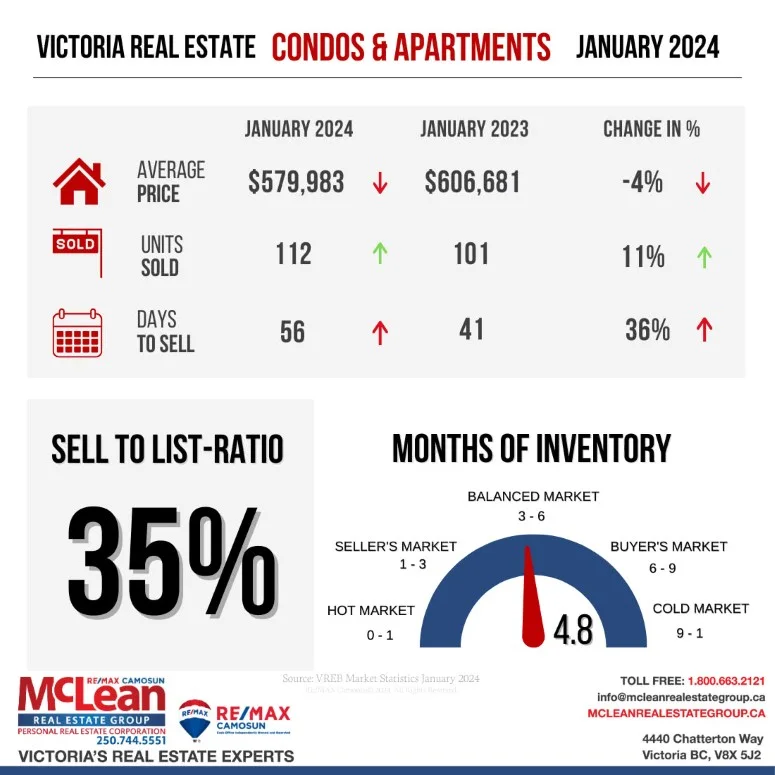

We were already seeing a cooling off in average price increases last month, so the 4% dip this month follows the existing trend. The average price for local Victoria single-family homes in January 2024 fell a surprising 4% compared to January 2023. Dig into all the stats here: January 2024 Victoria BC Area Realty Statistics

*source of information in this blog post

Victoria Real Estate Board

Canadian Real Estate Association

Suze Cumming, The Nature of Real Estate