February Brings a Big Uptick

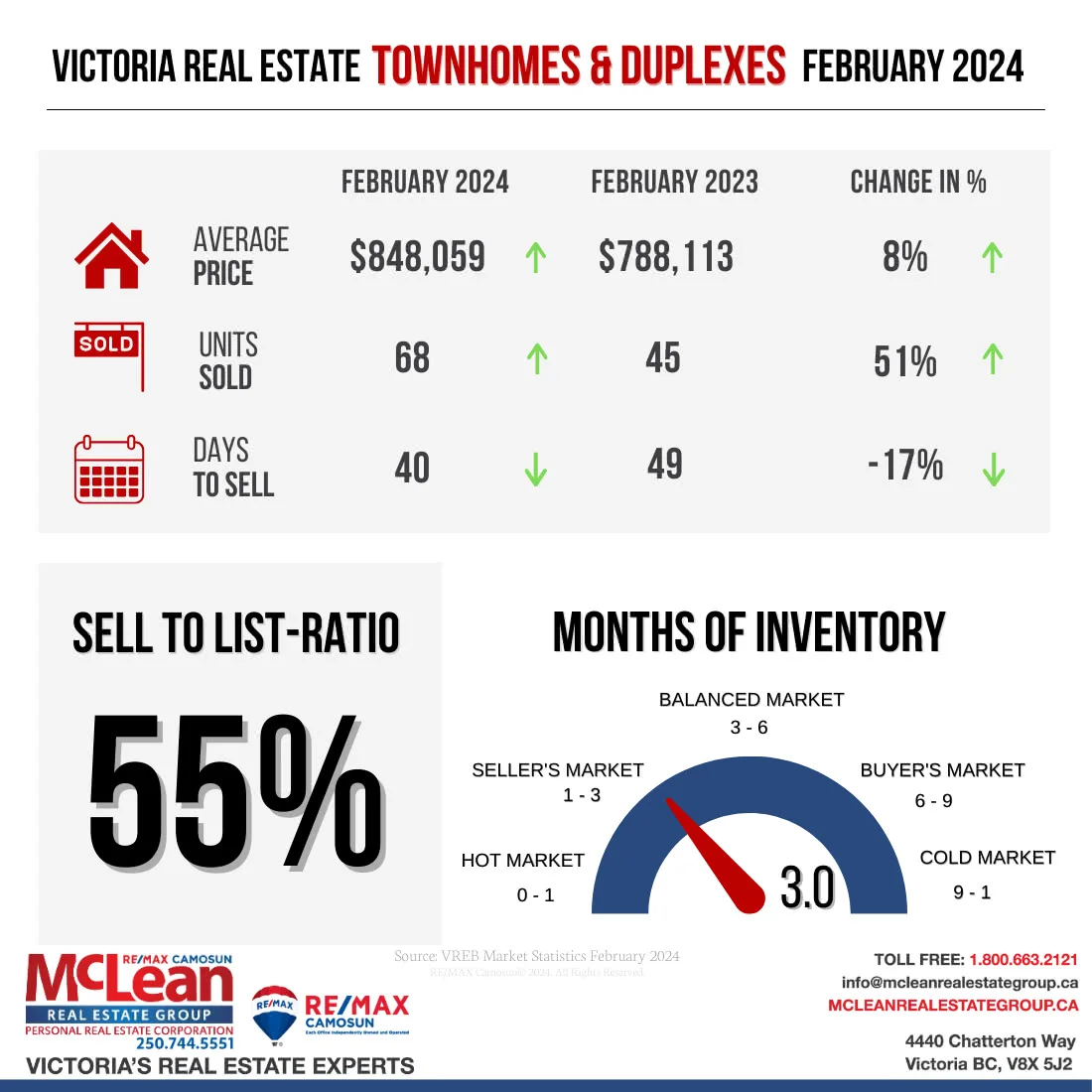

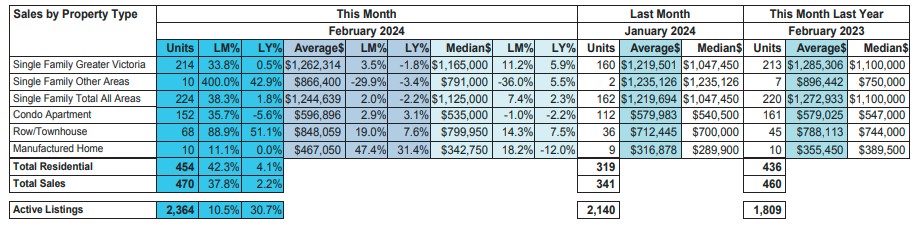

In February 2024 we have seen 470 properties sold which is a 37% increase in sales in comparison to January of this year. There were 2,364 active listings at the end of February which increased 10.5% from the previous year which is great for inventory on the market. View the complete Victoria Realty Statistics for February.

I have been speaking with a few Realtors® in our office and the consensus is that they are already seeing an uptick in the market. Homes that have been for sale and sitting last year are now getting offers which bodes well for sellers. I have even been involved in a multiple offer situation recently for a home that was listed last October which was surprising.

Consumer Confidence on the Rise

The Bank of Canada did not raise the interest rate in January, so we are seeing more consumer confidence when shopping for homes. My take is that now is a great time to buy as prices remain relatively flat but if interest rates start to lower in the summer and fall, we will start seeing those prices creep up a bit.

Spring is historically the busiest time for sellers and buyers, and I suspect more homes will go up for sale after Spring Break.

Data from Victoria Real Estate Board (VREB)

BC’s Property Transfer Tax

Three significant changes are coming to British Columbia’s Property Transfer Tax (PTT) framework to enhance housing affordability:

The first-time homebuyers’ exemption threshold will rise from $500,000 to $835,000, with properties under $500,000 being fully exempt. This change, effective April 1, 2024, is expected to benefit approximately 14,500 people, doubling the previous number, with potential savings of up to $8,000.

The exemption for newly built homes will increase from $750,000 to $1.1 million, also starting on April 1, 2024, with a phase-out range for homes valued between $1.1 million and $1.15 million.

A new PTT exemption will be introduced for purchases of qualifying secured purpose-built rental housing buildings. This exemption, applicable from January 1, 2025, to December 30, 2030, aims to stimulate the development of “missing middle” rental housing.

>> Estimate your property transfer tax.

These changes are anticipated to collectively reduce transaction costs by over $100 million annually. Despite these adjustments, property transfer tax growth is expected to rise by an average of 8.6% annually over the next two fiscal years.

The Real Estate landscape is changing and the idea of buying and selling can be daunting. If you have any questions about what is happening, please reach out and someone from our team will be happy to help.

Darren Neuhaus

REALTOR®

McLean Real Estate Group

RE/MAX Camosun