The Victoria real estate market is showing signs of stability and predictability that we haven’t seen in recent years. According to Laurie Lidstone, the 2024 Victoria Real Estate Board Chair, we’re experiencing a market that is closer to balance, meaning it’s not heavily skewed in favor of either buyers or sellers. This balanced state offers advantages to both sides of a transaction.

Declining Interest Rates

We’re currently seeing downward trending interest rates, stable pricing, and an increase in available inventory. This combination has created a more comfortable environment for buyers and sellers to navigate the market. Even ahead of the anticipated interest rate cuts by the Bank of Canada, the prospect of lower rates is already boosting confidence among potential first-time homebuyers. Interestingly, a quarter of Canadians (25%) are actively saving for a home, feeling optimistic about buying soon. This optimism is especially strong among younger Millennials and Gen Zs aged 18-24, with 35% expressing confidence in their ability to purchase a home.

However, it’s not all positive. While declining interest rates are a boon for some, they might come too late for certain current homeowners. Around 14% of homeowners will need to renew their mortgages soon, and with the current higher rates, some might face the difficult decision of having to sell their homes.

The market’s stability, combined with shifting interest rates, will continue to shape the real estate landscape in Victoria as we move through the fall season.

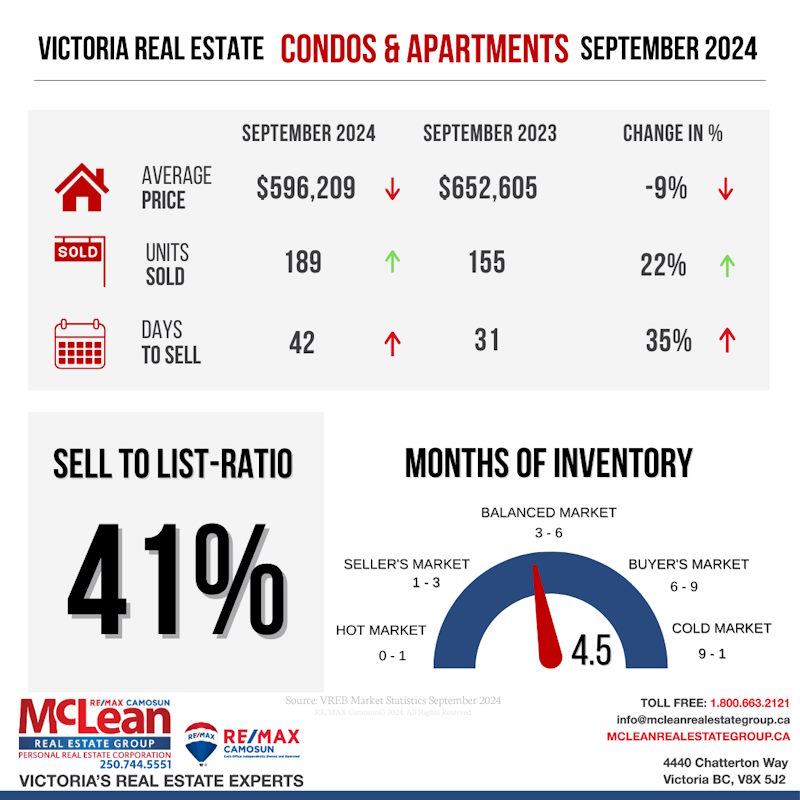

Victoria Real Estate Stats for Condos and Apartments in September 2024

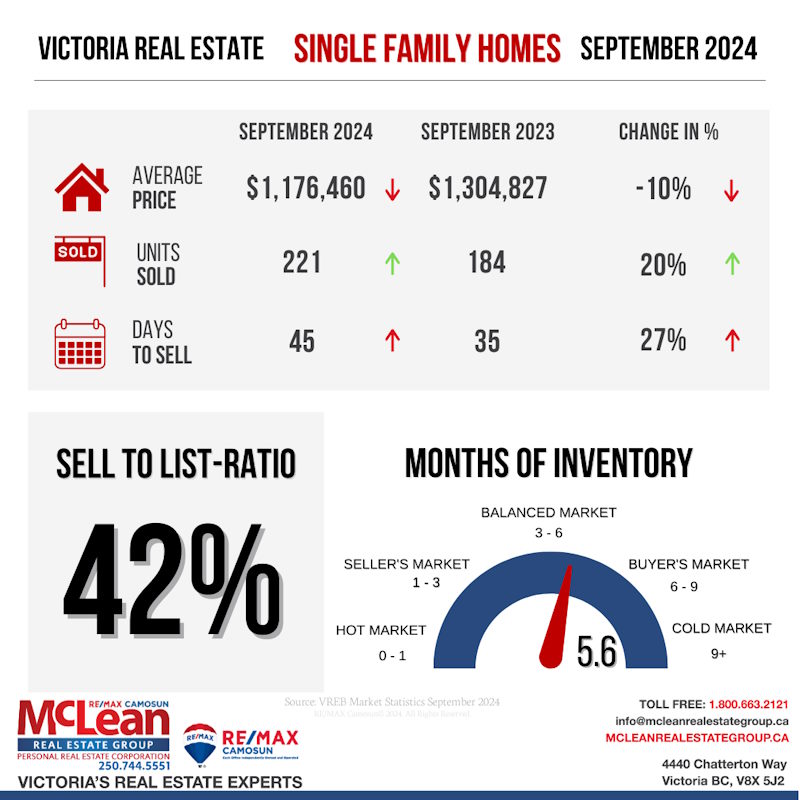

Victoria Real Estate Stats for Single Family Homes in September 2024

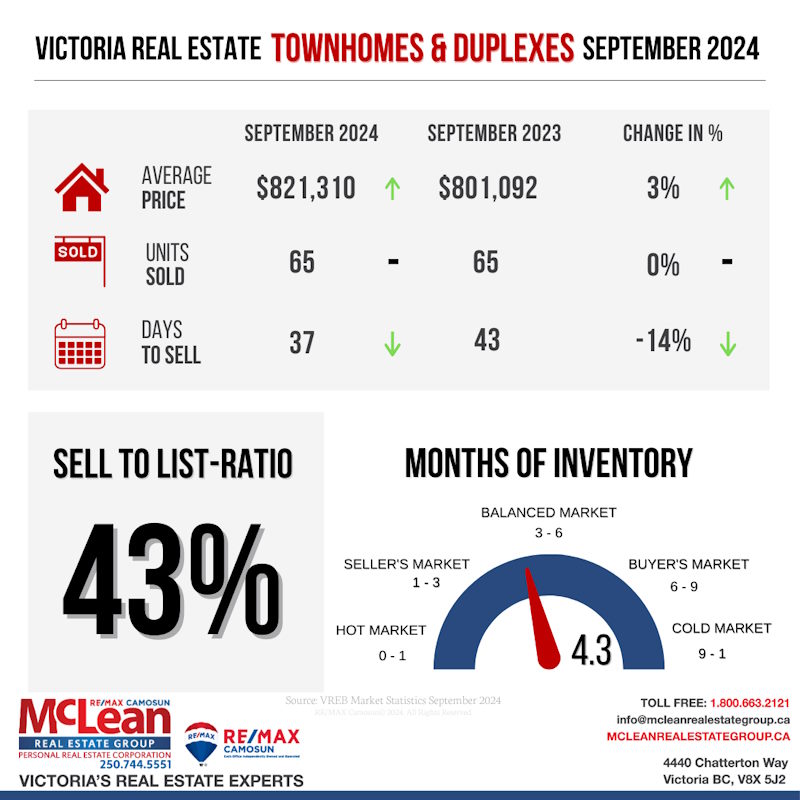

Victoria Real Estate Stats for Townhomes and Duplexes in September 2024